U.S. Exporter Support > What is my Tariff?

What is my Tariff?

How to Determine Tariffs Under the KORUS FTA

The following provides a step-by-step guide to determining the Korean tariff applicable to your product under the KORUS FTA. Keep in mind that, if the tariff is not already zero, it will likely be reduced every year on January 1 until it reaches zero.

As an initial step, you may wish to utilize FAS’ Tariff Tracker Tool. For a more thorough review, please see below.

Tariff information is listed by ten-digit codes in the Harmonized Tariff Schedule of Korea (HSK). Most agricultural products are found in the first 24 chapters of the HSK (thus, codes beginning with 01-24.) See more under Step 2 below.

Please click on a step for more infomation.

Determine Whether Your Product Qualifies as a U.S. Product

Korea’s tariff reductions under the KORUS FTA apply only to U.S. products. Therefore, you will want to be sure your product meets the rules of origin for U.S. products under the Rules of Origin chapter (Chapter 6) of the Agreement. In general, to qualify, products must meet one of two requirements:

1. They are wholly produced or obtained from the United States and Korea. For example, raw crops and other plant products have been grown or harvested in the United States or Korea; animal products, such as meat, have been obtained from animals in the United States or Korea; or, fish and seafood from outside the United States or Korea have been harvested by vessels registered in and flagged by either country.

2. For products originating outside of the United States (or Korea), transformation resulting in a change in tariff classification should be demonstrated. Sugar (HS Chapter 17) imported into the United States and used in chocolate confectionary (HS Chapter 18) would be an example of this.

Please note: FAS Seoul recommends Country of Origin documentation be maintained on file for five years.

Korea Customs Service (KCS) can request this information when making origin determinations.

If you have any question about whether your product qualifies you may contact agseoul@fas.usda.gov.

Identify Harmonized Tariff Schedule of Korea (HSK) code

Tariff reductions by Korea under the KORUS FTA are listed in the Tariff Schedule of Korea appended to the Agreement as Annex 2-B.

If you do not know the HS code applicable to product, you can start with the U.S. Census Bureau’s Search Engine, which allows you to find the HS code based on a description of your product.

To use the U.S. Census Bureau’s Search Engine, for example, searching the word ‘ketchup’ yielded the following:

The applicable ten-digit code (under the U.S. HS system) for ketchup is 2103.20.2000. This is a good starting point for identifying your code under the Note: The entire Harmonized Schedule of the U.S. can be viewed on the U.S. International Trade Commission’s website at Official Harmonized Tariff Schedule of the United States.

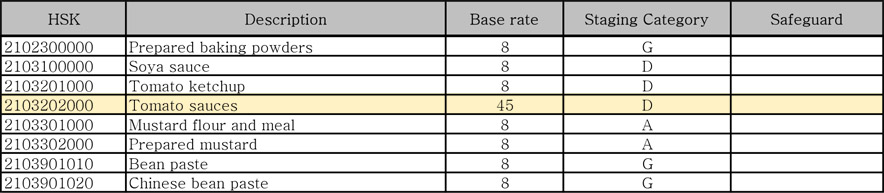

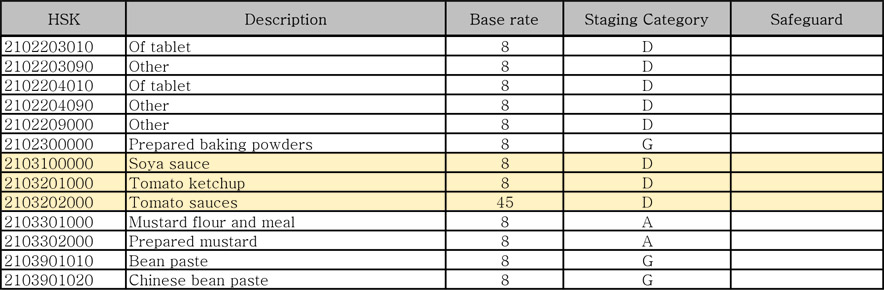

Now, to find the Harmonized System of Korea (HSK) code for your product, open the Tariff Schedule of Korea and look under 2103. The Harmonized System of Korea (HSK) code for ketchup appears to be HSK 2103201000.

IMPORTANT: Before you export, you may want to consult with your importer. The Korean Customs Service should provide the authoritative classification of your product under the Korean system.

Identify Duty Reduction Schedule

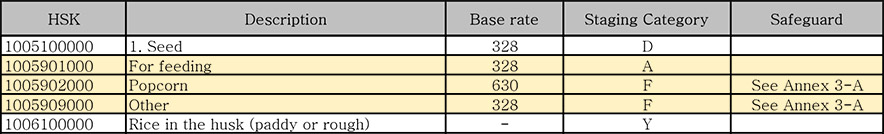

To determine the duty reduction or staging category that applies to a specific product, you must refer to the Tariff Schedule of Korea. The Tariff Schedule of Korea shows the harmonized schedule of Korea (HSK) tariff line number, a description of the product, the initial or base tariff rate and the staging category by which the base rate will be reduced. If the product is subject to a safeguard, it will be indicated in the safeguard column.

In Step 2, you identified the HSK tariff line code for ketchup as 2103201000. The ‘base rate’ column indicates the beginning tariff, usually in ad valorem terms unless specified otherwise. Ad valorem indicates the percentage of the value of the product that is accessed as the tariff or duty. For example, if $1000 worth of tomato ketchup were imported into Korea, Korean customs would assess 8 percent of $1000, or $80, as the duty. The staging category indicates how the duty will be phased out under the KORUS Agreement. Usually a letter appears in this column, but if there is a note referring to Appendix 2-B-1, see Step 4 below.

Based on the letter under the staging category, you can determine the applicable duty under the KORUS FTA. For a quick reference, you can refer to this unofficial Staging Category table, which shows you that Staging Category or Tariff Reduction Category ‘D’ means that the tariff will be eliminated in five equal reductions. For the initial tariff of 8 percent, each annual reduction would be equal to 1.6 percent. Since the first reduction was made upon implementation of the Agreement (Year 1--2012), the duty applied upon implementation was 6.4 percent. On January 1 of the second year, i.e. 2013, the duty was reduced another 1.6 percent, to 4.8 percent, and so on until 2016 (year 5) when the duty on tomato ketchup was eliminated and U.S. product began entering duty-free.

Annex 2-B

Tariff Schedule of Korea

It is important to remember that:

① The first tariff reductions took place upon implementation, or entry into force, of the Agreement in 2012.

This is considered Year 1. Subsequent reductions take place on January 1 of each year.

② Ad valorem tariff rates are rounded down to the nearest 0.1 percent.

③ Duties on products that are subject to safeguards (indicated in the 5th or Safeguard column of Annex 2-B)

may change during the year. See Step 5 below.

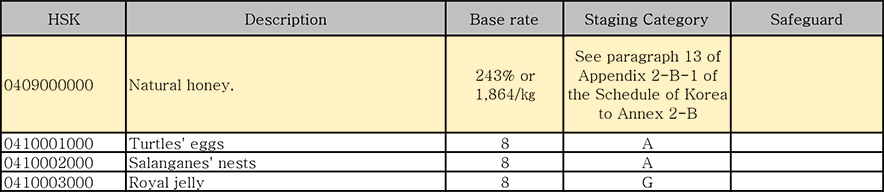

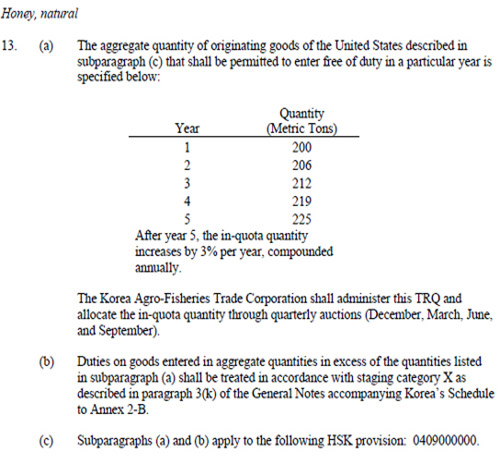

Understanding when and how Tarriff-rate quotas are applied

If the Staging Category in Annex 2-B refers to Appendix 2-B-1 for Korea, then your product is subject to a tariff-rate quota (TRQ). Under a TRQ, a pre-established quantity may enter under a lower duty. Appendix 2-B-1 for Korea provides details on each of the 19 TRQs for U.S. products. For example, Annex 2-B indicates that honey (0409000000) is subject to a TRQ.

Since the specific details for each TRQ differ, it is a good idea to refer to the language in Appendix 2-B-1 which applies to your product. It is important to keep in mind that many of the TRQs incorporate products from multiple tariff lines.

For example, paragraph 13 of Appendix 2-B-1 provides details for the TRQ on honey:

Subparagraph (c) indicates that only one tariff line is included in the TRQ. Subparagraph (a) indicates that 200 metric tons of honey were eligible for duty-free entry on implementation of the Agreement (Year 1--2012), and this amount increased to 225 MT in year 5 (January 1, 2016). Since that time, the zero-duty amount has increased by 3 percent annually and stands at 253 MT in 2020. Subparagraph (b) indicates that once imports under the duty-free quantity have been reached in any given year, the tariff will revert to Staging Category X which is the base rate. For honey, this is 243 percent or 1,864 Korean won per kilo, whichever is greater.

Understanding how Agricultural Safeguard Measures are applied

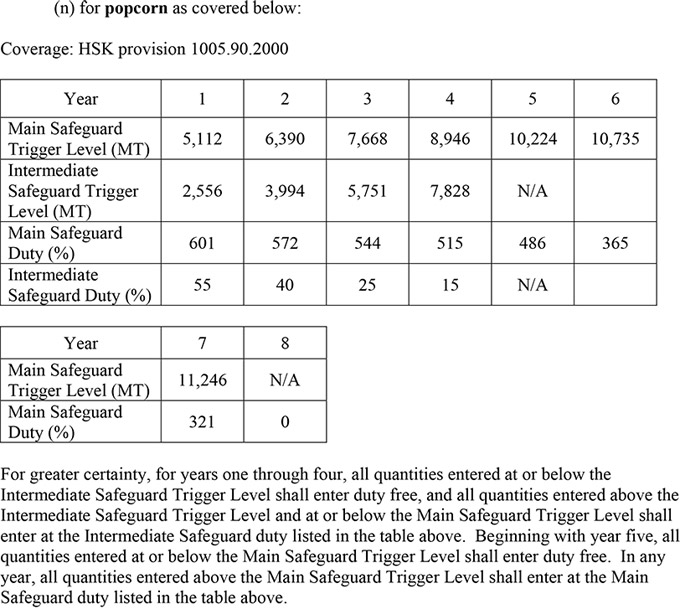

Annex 2-B indicates that the duty on popcorn (HSK 1005902000) is Staging Category F, which means the 630 percent duty will be reduced in seven equal stages: Year 1: 540 percent, Year 2: 450 percent; Year 3: 360 percent; Year 4: 270 percent; Year 5: 180 percent; Year 6: 90 percent; Year 7: no duty. However, Annex 2-B also indicates that popcorn is subject to a safeguard (indicated by note ‘See Annex 3-A’ in Safeguard column.) A safeguard establishes a quantity of imports, which once reached in any given year, will trigger an increase in the tariff applied under the KORUS FTA

The details for each safeguard are contained in Annex 3-A Agricultural Safeguard Measures at the end of Chapter 3 of the Agreement. For example, paragraph 3 (n) of the Annex (page 3-13) provides details on the safeguard for popcorn.

For year 5 the safeguard trigger level is set at 10,224 metric tons. The note indicates that imports up to this amount would be assessed zero duty; however, on imports beyond this amount, the duty would be assessed the safeguard duty of 486 percent. Year 1 is a bit more complicated: up to 2,556 MT of U.S. popcorn would enter at zero duty; imports above 2,556 MT but below 5,112 MT would enter at a 55 percent duty. Imports above 5, 112 MT would enter at a 601 percent duty.

For current Tariff Rate Quota fill rates and the status of Special Safeguard Mechanisms see the Safeguard section under Market Information

Agricultural Trade Office, U.S. Embassy - Seoul

Tel: 82-2-6951-6848 Fax: 82-2-720-7921

Email: atoseoul@state.gov